November 12, 2024

Key insights from September quarter FY25

- Housing issues will influence how the vast majority of Australians (87%) vote in the upcoming Federal election.

- Increasing anticipation of rate cuts is fuelling positivity among prospective buyers, with more feeling hopeful and fewer reporting interest rates are making them less confident.

- A drop in interest rates is set to be the turning point that prompts prospective buyers to act on their purchase plans, particularly those in Sydney and Melbourne.

- Mortgage Choice home loan submission data reveals that rising average loan sizes are being driven by investors, buyers and those seeking finance for construction, with the value of refinancing falling over the quarter.

Mortgage Choice CEO Anthony Waldron said, “The consumer research conducted for this Report sheds light on which housing-related policies matter most to Australian voters, how Australians believe the Federal Government could help make home ownership more achievable, and on the purchase plans of prospective buyers and borrowers.”

Housing – what Australians want from federal election commitments

With a federal election coming within the next six months, the consumer research explored voter attitudes around key housing issues, and the influence these issues may have on their vote. An overwhelming 87% of Australians consider housing at least somewhat important in how they will vote, with 93% of Millennials citing it would be a key factor when deciding how they would vote.

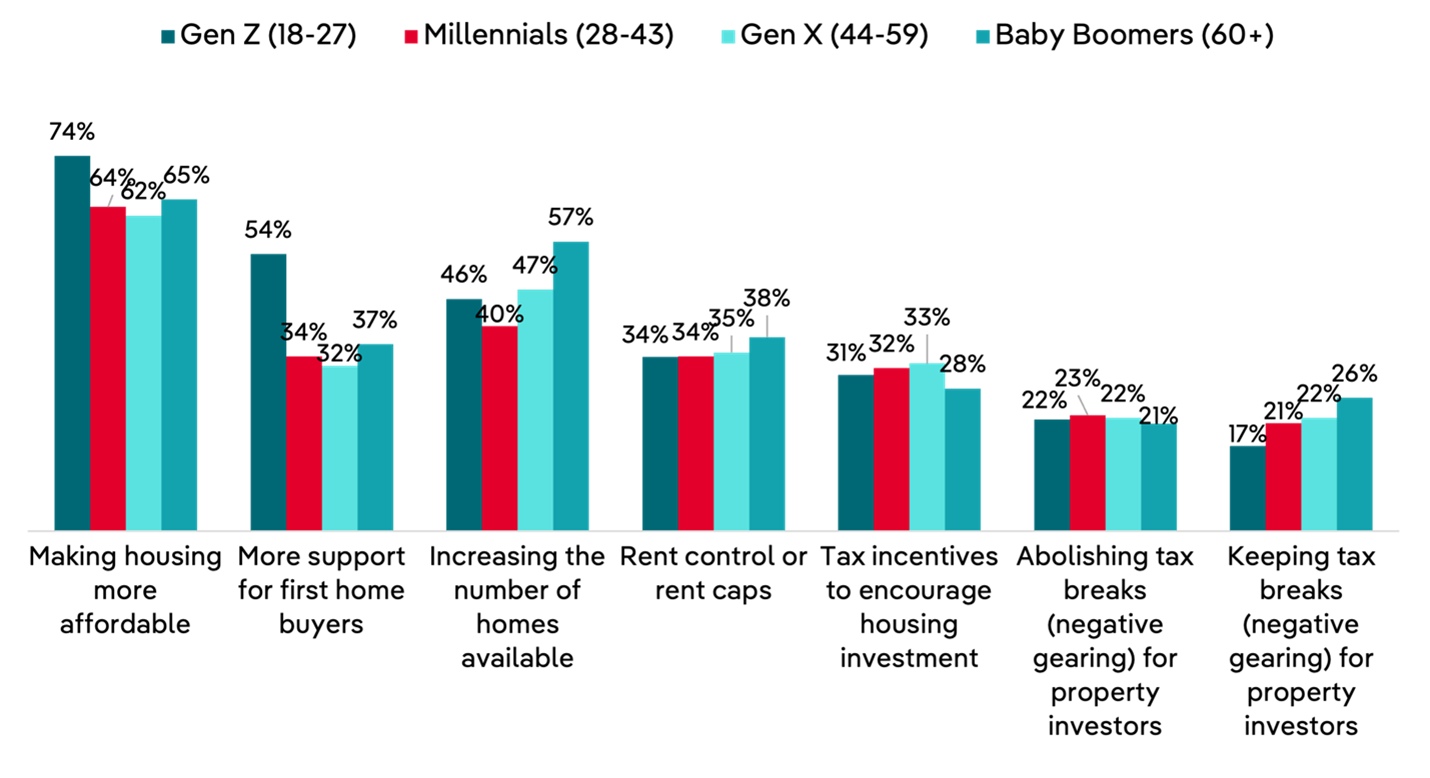

The housing-related issues of most importance:

- Making housing more affordable (65%)

- Increasing the supply of homes (47%)

- Increasing support for first home buyers (37%)

- Rent control (35%)

- Tax incentives to encourage housing investment (31%).

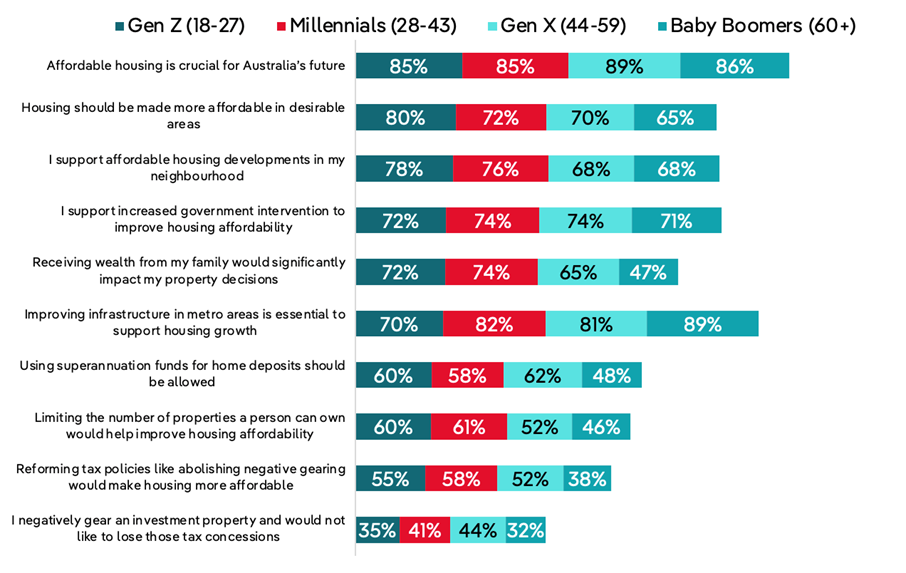

Mr Waldron said, “The Mortgage Choice Home Loan Report reveals that those with a mortgage are supportive of increased government intervention to improve housing affordability (71%), but opinion is divided on the measures used to achieve this. While almost half (47%) of survey respondents with a mortgage said that reforming tax policies would make housing more affordable, 46% of mortgage holders surveyed currently negatively gear an investment property and would not like to lose those tax concessions.”

Which housing-related issues or policies would be most important to you in the next Federal Election?

A generational breakdown reveals that younger generations selected making housing more affordable and increasing support for first home buyers as the most important issues in the coming election, while Baby Boomers placed more importance on boosting housing supply than other generations.

To what extent do you agree with the following?

All survey respondents, regardless of their age, agree that affordable housing is crucial for Australia’s future.

A distinct generational difference emerges around support of affordable housing developments, with 78% of Gen Z respondents in agreement, versus 68% of Baby Boomers noting they support these developments.

There was unanimous agreement across all generations that improving infrastructure in metro areas would be essential to support housing growth, with Baby Boomers most in agreement (89%).

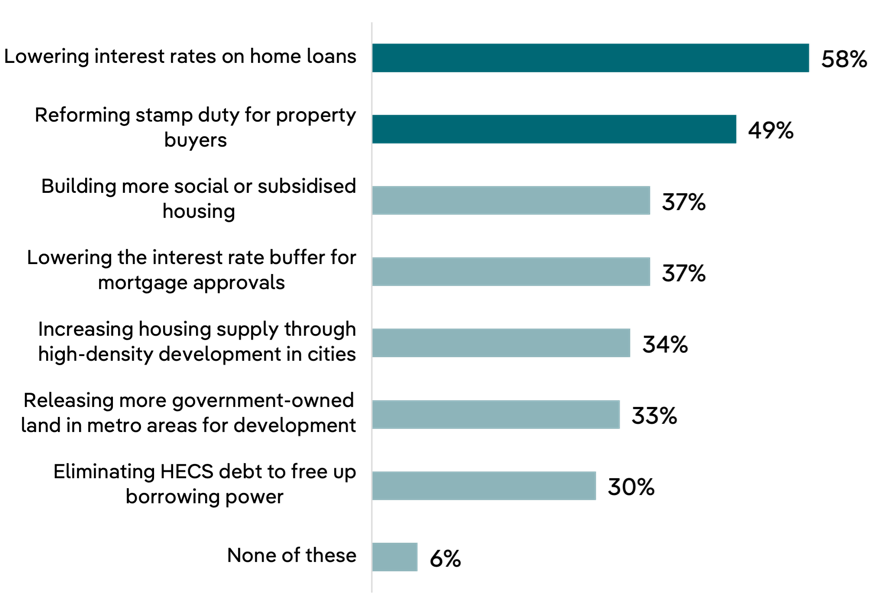

What would make homeownership a more achievable goal for future generations?

When asked what would make homeownership a more achievable goal for future generations, nearly 60% of survey respondents saw lowering interest rates as a solution, followed by stamp duty reform (49%), and lowering the interest rate buffer on mortgages (37%).

Mr Waldron said, “It’s no surprise that consumers feel a reduction in home loan interest rates would make homeownership more achievable - a rate reduction would certainly improve borrowing power and reduce home loan repayments. It’s interesting to see consumers’ awareness about the potential power of stamp duty reform, as I believe this tax presents one of the biggest barriers to first time buyers. Shifting to an annual land tax levied on all properties would improve housing supply and in turn benefit housing affordability.”

Future rate cuts fuelling confidence

Mr Waldron said, “Each quarter we ask consumers how they’re feeling about entering the property market. Our latest survey reveals that prospective buyers are feeling slightly more hopeful this quarter than they were last quarter – 46% vs 43%. Survey respondents were also feeling less anxious this quarter – 33% vs 39%.”

The survey conducted for this Report also reveals a shift in the impact interest rates are having on confidence, with fewer prospective buyers saying that interest rates had made them less confident to buy – 54% in October, versus 62% in June.

Respondents living in Sydney are the most impacted by interest rates, with 65% saying their confidence was impacted versus 50% in other cities.

Mr Waldron said, “There are a couple of reasons why prospective buyers might be feeling more optimistic about their purchase plans. With the cash rate on hold throughout 2024, home loan interest rates have remained relatively stable. We’ve also seen an increase in the availability of homes to buy, with the PropTrack Listings Report revealing that new listings in September 2024 reached their highest volume since September 2015, giving buyers more choice and more time in their purchasing journey.

“We asked survey respondents who identified as prospective buyers when they were hoping to buy, and 20% said this summer, and 23% said they were hoping to purchase in autumn 2025.”

Interest rate drop to trigger activity

Mr Waldron said, “The research reveals that those who are looking to buy in 2025, are waiting for house prices or home loan interest rates to fall to put their plans into action. This is particularly the case for respondents living in Sydney (50%) and Melbourne (48%). If the Reserve Bank decides to cut the cash rate in early 2025, we may see the timing of some of these purchases brought forward.

“Victorian property prices have been comparatively subdued in 2024, driven by home loan interest rates, a large volume of stock available for sale, and state government policies that have impacted property investment. A fall in home loan interest rates is likely to be a boost for the Victorian market.”

Average loan size continues to rise

|

Average loan submission size |

Value |

Annual growth |

|

NSW/ACT |

$709,026 |

7.1% |

|

VIC/TAS |

$625,987 |

7.6% |

|

QLD |

$569,649 |

13.3% |

|

SA/NT |

$576,957 |

16.2% |

|

WA |

$525,952 |

15.0% |

|

National |

$611,932 |

10.2% |

*Total value of Mortgage Choice loan applications divided by number of applications submitted over September 2024 quarter.

Mortgage Choice home loan submission data revealed that the national average loan size continues to trend 10% higher than it was last year. For the September quarter, average loan sizes were higher within every state and territory around the country. SA/NT and WA recorded the highest annual growth, respectively.

Mr Waldron said, “When you consider that average loan sizes have grown for the last three quarters, it’s no surprise that prospective buyers are waiting for home loan interest rates to fall to put their purchase plans into action.

“While most economists predict that a rate cut is coming, the timing of that cut remains uncertain – especially given the latest data from the Australian Bureau of Statistics shows that underlying inflation remains high and employment growth is strong. My advice to hopeful buyers would be to buy when you’re ready and avoid trying to time the market.”

Investment activity rises

|

Loan purpose |

Change in value YoY |

|

Owner occupied |

7.3% |

|

Investment |

28.9% |

|

Total |

12.7% |

Mortgage Choice home loan submission data reveals that the value of loans for investment rose nationally almost 29% over the September quarter, following a rise of close to 21% in the June quarter.

QLD (51.5%) and WA (52.3%) had the largest growth in the value of loans for investment over the September quarter, followed by NSW/ACT (21.3%).

“Investor activity in the Sunshine State has been strong in 2024, and the September quarter was no different,” said Mr Waldron. “Queensland remains an attractive opportunity for investors, with strong interstate migration, high rental yields and low vacancy rates in regional areas and ongoing infrastructure investments providing long-term growth potential.”

Purchase and construction remains strong

|

Loan purpose |

Change in value YoY |

|

Purchase |

21.6% |

|

Construction |

12.6% |

|

Refinance |

-0.4% |

|

Total |

12.7% |

Mortgage Choice home loan submission data reveals that over the September quarter the value of loans for purchases increased 21.6% year on year, and the value of loans for construction increased 12.6%, with the value of loans for refinance falling 0.4% year on year. Submission data reveals that demand for construction loans remains strongest in QLD (33.6%), and WA (54.4%).

The fall in the value of loans for refinance over the September quarter follows a 20.8% fall over the June quarter.

Mr Waldron said, “Mortgage Choice submission data reveals that the even though demand for refinancing continues to trend down year on year, the data shows that the rate of decline has slowed significantly when we compare the September 2024 and June 2024 quarters.”

For further information, or to arrange an interview, please contact:

Graciela Gomez

Mortgage Choice Corporate Communications

+61 432 520 164

graciela.gomez@mortgagechoice.com.au

Important information

This article is for general information purposes only. It has been prepared without considering your objectives, financial situation or needs. You should, before acting on the advice, consider its appropriateness to your circumstances.

About the Report

The Mortgage Choice Home Loan Report is a quarterly release that looks at Mortgage Choice submission data, which represents all home loan applications submitted by the Company’s franchise broker network, and a consumer survey of 1,000 Australians conducted over October 2024 by Honeycomb Strategy.