Questions? Call Jason today on 0448 481 819 or email us here:

We can help you and your business manage short and longer term funding needs. We have access to small business loans up to $500,000. We can assist to Grow your business and cashflow. We have access to fast and flexible loans for your business.

We offer fast, easy funding solutions to small businesses to keep up the momentum. If you need business funding to take advantage of an opportunity or to boost your cash flow, talk to us today – and get on with business, sooner.

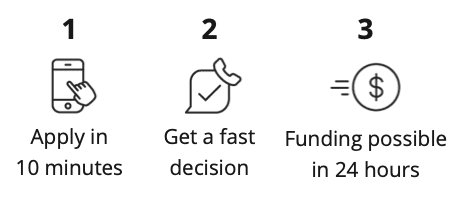

Want a business finance solution with a smooth application process? All it takes is ten minutes to apply, you could get a decision the same day and the money you need could be in your account in 24 hours – so you can get on with business, sooner.

We take the hassle out of getting business funding, we want to help you and your business access the funds you need to keep momentum going.

We believe in small business and we’re here to support you with the funds to support cash flow or achieve your next goal.

Need funds for an opportunity or to support cash flow? We can help you find a solution to suit your business. Enjoy fast, easy application on a Small Business Loan or a Line of Credit, with funding possible in 24 hours to approved applicants.

Business funding from $2K to $500K

Cash flow friendly repayments over terms from 3 – 36 months

Apply online in 10 minutes, same day decision possible

No asset security required upfront to access total funding up to $150K

Hassle-free process with funding possible in 24 hours

Business financials for certain loan amounts may be required

If you need access to a lump sum to cover a one-off business expense.

Loan amounts from $5K to $500K

Fixed repayments over terms of 3 up to 36 months

Minimal documentation

Business financials for certain loan amounts may be required

Early payout option available

If approved, use your Small Business Loan to add a new product or service, purchase tools, upgrade equipment or machinery, do a renovation or fit out, run a marketing campaign, build a website and more.

If you need ongoing access to funds to manage day-to-day business cash flow.

Facility limit between $2K and $150K

Use and reuse as often as you like

Only pay interest on what you use

while you use it

24-month renewable term

If approved, use your Business Line of Credit to manage cash flow gaps, pay staff wages, cover unpaid invoices, buy urgent stock, manage seasonal fluctuations, pay suppliers, manage late paying customers and more.

All you need to have ready is your driver’s licence number and your business ABN. You can choose to allow us to use an advanced bank verification system link to instantly verify your bank information online and your application will be processed faster, in which case – have your main trading bank account details handy. Alternatively, you can choose to upload copies of your bank statements. Please make sure you have 6 months of statements as PDF documents ready to upload. Depending on how much you want to borrow, you may need financial statements too.