Mortgage Broker in Umina Beach , Woy Woy & Ettalong Beach

26/08/2024

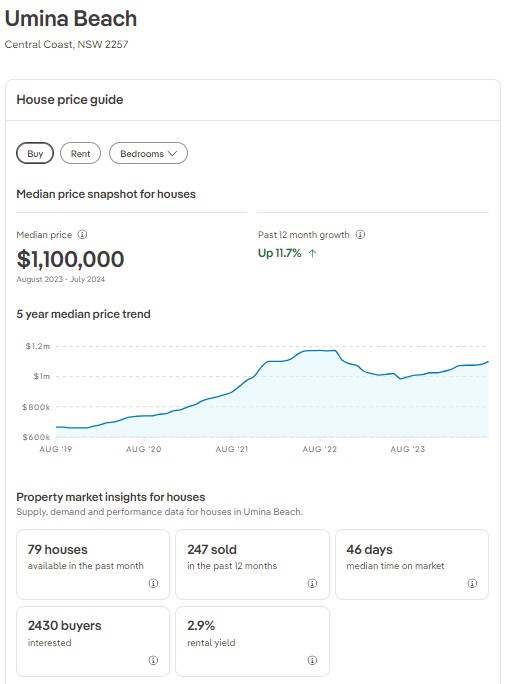

Median House Price for Umina Beach www.realestate.com.au - Umina Beach

21/08/2024

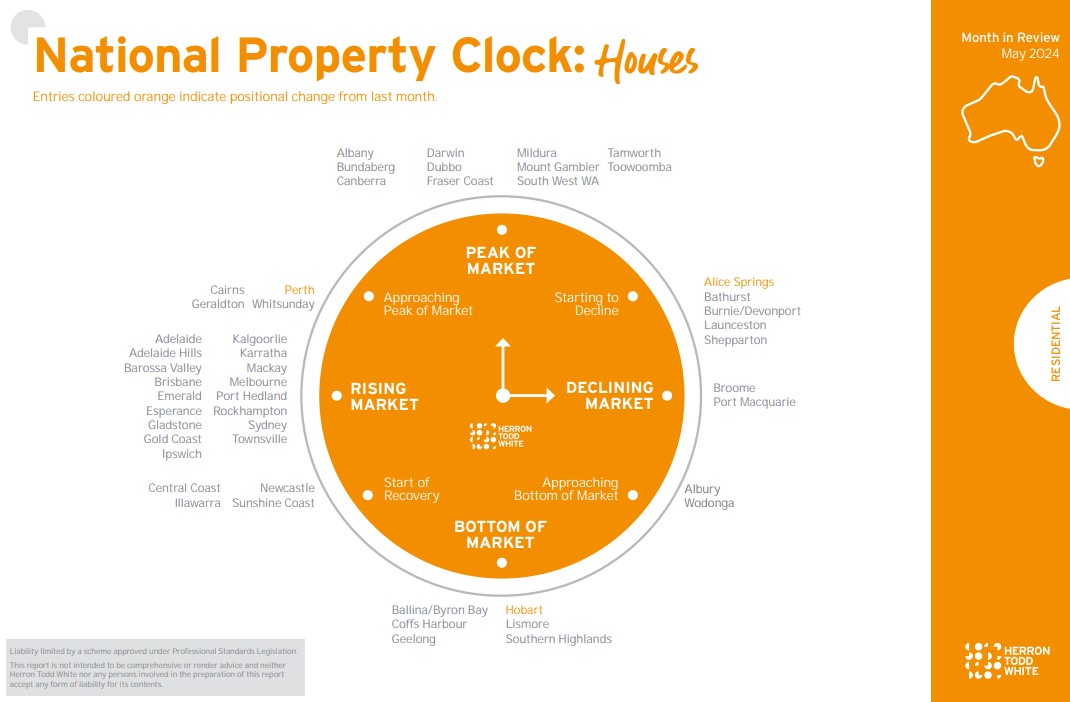

Central Coast Houses remain in the "Start of Recovery" phase (May 2024)

According to the Herron Todd White valuation firm's monthly property clock report, the Central Coast house markets are in the "Start of Recovery" phase.

As we have been pointing out for a few months now, the Central Coast residential housing markets have benefited from the lack of affordability in the Sydney Market. Interestingly, HTW has placed Sydney in the "Rising Market" category, so we can probably expect the overflow demand to continue.

Should you need advice from an experienced Central Coast Mortgage Broker, please call Mortgage Choice Erina.

Does the Central Coast property market follow Sydney? (May 2024)

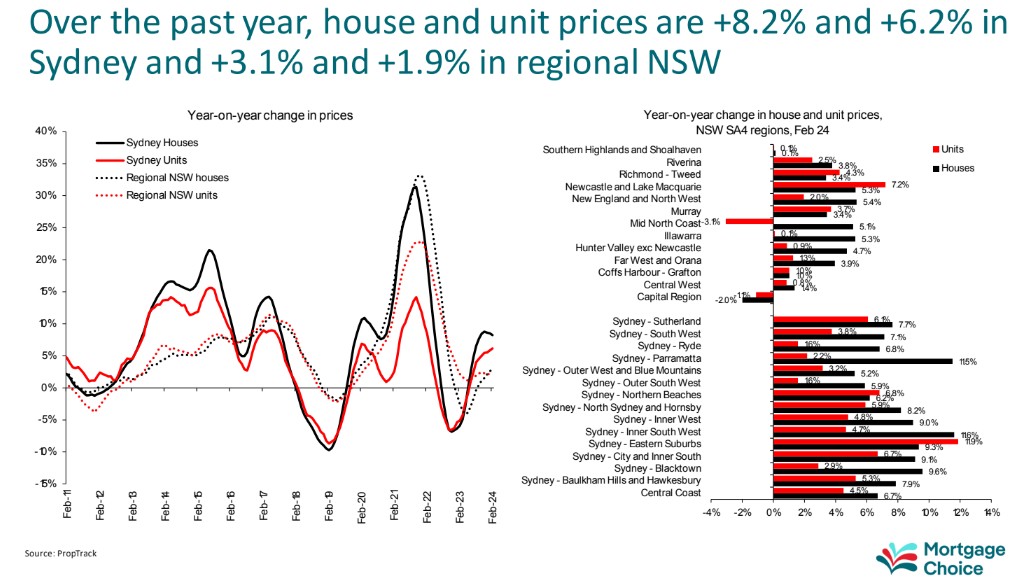

These charts give us some valuable information about the performance of Central Coast house prices.

1. Between March 2020 and February 2024, house prices rose by 47%, and unit prices rose by 34.3%.

2. Central Coast units outperformed all fifteen Sydney markets but came tenth out of thirteen regional markets.

3. Central Coast house prices rose, placing them third out of fifteen Sydney markets, but only outperformed one of the thirteen regional markets.

Central Coast houses and units have behaved more like regional NSW markets. COVID-19 societal lockdowns impacted these results via a Sydney exodus. The post-2022 results will be interesting to observe.

Mortgage Choice Erina will continue to provide data to help you understand our market and its future.

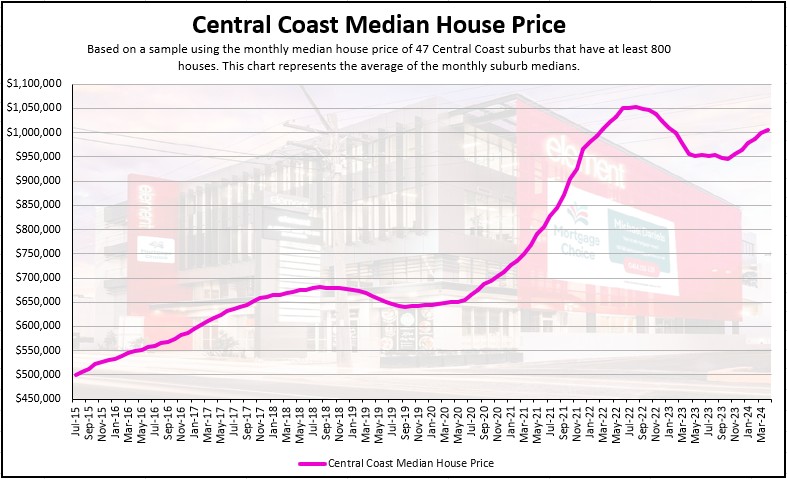

The Central Coast median house price breached $1,000,000 again (April 2024)

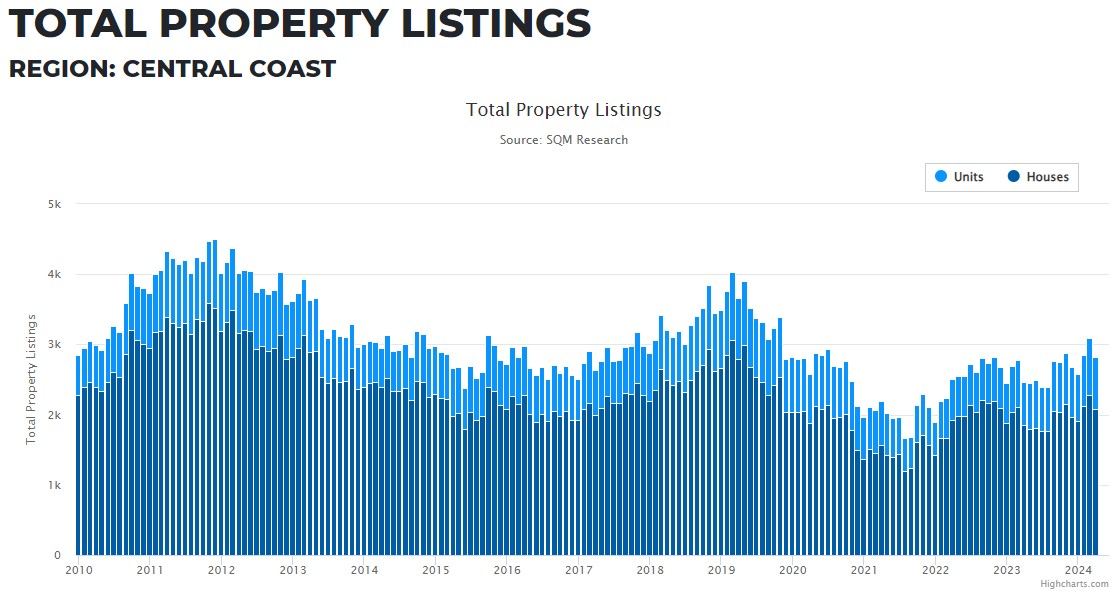

Property listings trending higher on the Central Coast (May 2024)

Although the number of residential property listings on the Central Coast is trending higher, the most recent month saw a dip, and we have not returned to pre-COVID levels.

Whilst the supply of property available for purchase remains relatively constrained, prices will continue to rise in a high-demand market. We will be keen to monitor this chart in the coming months to see if supply continues to reduce.

Please give us a call at Mortgage Choice Erina if you would like to discuss your home loan or investment plans.

"Start of Recovery" for Central Coast Houses (March 2024)

"Start of Recovery" for Central Coast Houses (March 2024)

Central Coast Houses out-performing Units (March 2024)

Units vs Houses on the Central Coast (March 2024)

This chart shows that house asking prices are trending higher than unit asking prices.

Units have remained steady for the last two years. House asking prices are now climbing higher after a brief fall.

The 'All Units' data shows the median asking price was $452,842 in March 2020. Four years later, it is $653,752, a 44.80% growth in four years.

The 'All Houses' data shows the median asking price was $774,072 in March 2020. Four years later, it is $1,309,548, a 69.17% growth in four years.

This chart shows that the proportion gap between unit and house prices was steady between 2009 and 2016. Unit prices were roughly 65% of house prices. As of March 2024, unit prices are now 49% of house prices.

We at Mortgage Choice Erina can only speculate why this has happened, but the supply of new houses has been limited, and the supply of units is accelerating. There are also some indicators that Sydney house seekers are being priced out of their market and looking for more affordably pastures on the hashtag#CentralCoast.

Please call us if you would like to discuss your property-buying plans. The property buying process starts with understanding how much you can borrow.

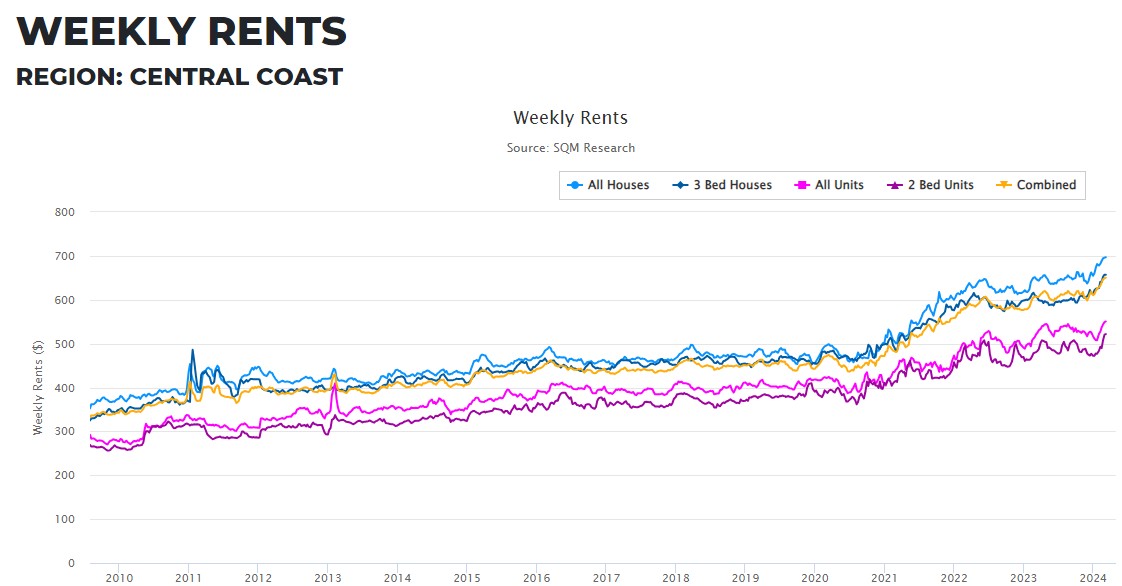

Asking Rents continue to rise on the Central Coast (March 2024)

Units come into the Central Coast Picture

The extraordinary increase in #CentralCoast house prices over the last five years has shifted our attention to more affordable options. And I'm not talking about Queensland.

Units and townhouses are now in focus, particularly for first-time home buyers, investors (looking for cash-flow-positive options) and downsizers.

First-home buyers in Sydney have always seen units as the obvious entry point into the market. This is now a more common reality for Central Coast first-home buyers.

One of Australia's biggest residential valuation firms, Herron Todd White, produces a monthly infographic that utilises their valuers to estimate the stage of the local property cycle.

The Central Coast unit market moved from the "bottom of the market" to the "start of recovery" phase.

If you would like to discuss purchasing a unit or townhouse, please call me about establishing a pre-approval.

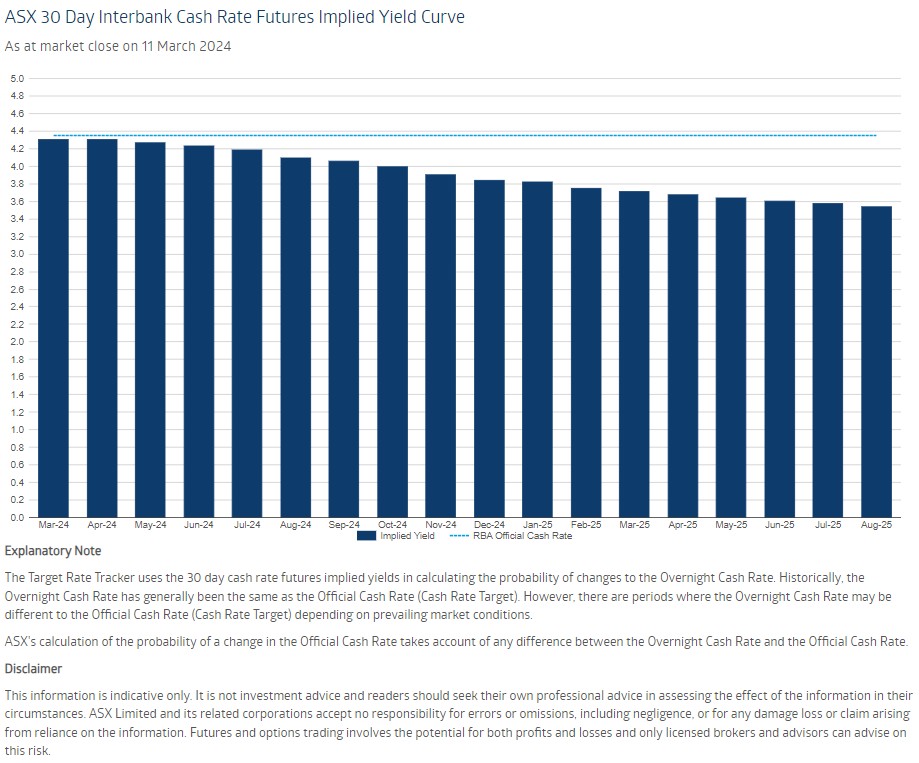

Big Bank RBA Cash Rate Forecasts (March 2024)

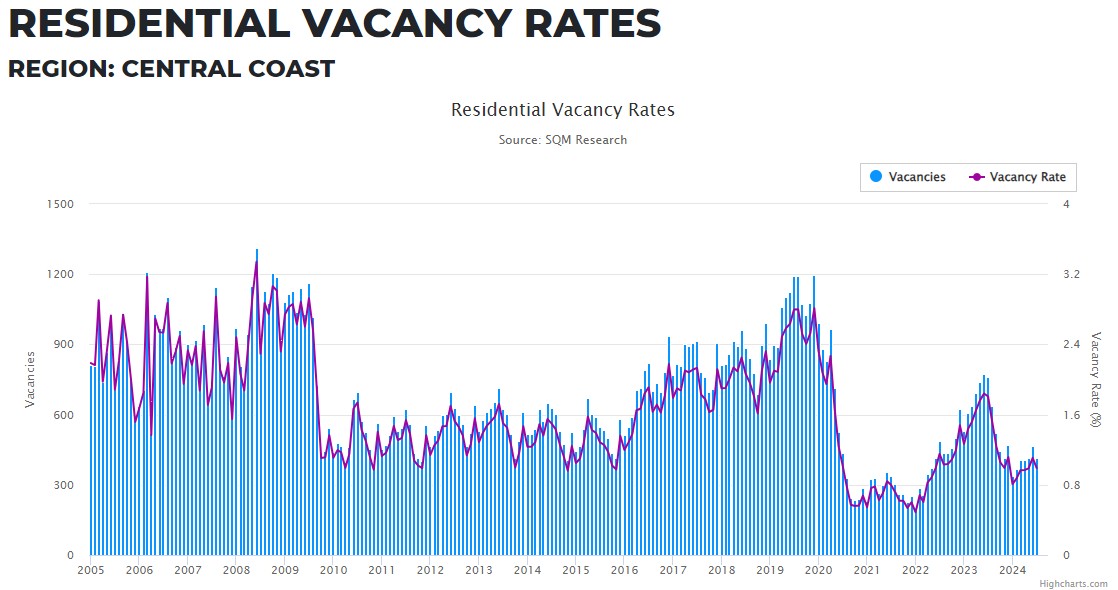

Central Coast Rental Vacancy Rates (February 2024)

Very few charts demonstrate the impact of "The great Sydney Covid escape" like this one.

Right before COVID-19, the Central Coast had approximately 1,000 vacant investment properties. When the lockdowns became a reality, those vacancy numbers quickly dropped to a record low of 200.

As the lockdowns receded and Sydney employers required on-site attendance, people began to move back to Sydney. Over the next 18 months, around 500 additional dwellings became vacant.

Interestingly, the rental vacancy rate has risen for the last 12 months. There are now approximately 300 vacant dwellings. We suspect this has a lot to do with Sydney's deteriorating housing affordability levels. Higher interest rates and dramatically higher rents again force people away from the big smoke.

If you want to discuss your investment property options, please call me at Mortgage Choice Erina.

Central Coast Rental Vacancy Rates (April 2023)

Average Big 4 bank interest rate chart (April 2023)

Our "Mortgage Choice Erina" monthly average interest rate chart has been updated for April 2023.

As you can see, the average 3-year fixed rate and the average 5-year fixed rate have stabilised and even slightly reduced.

The massive increase in variable interest rates by the Reserve Bank of Australia is hopefully coming to an end very soon.

Most of the major bank economists are predicting one or two more 0.25% increases, however, the ASX futures market is predicting that we may have peaked.

Our Central Coast economy would benefit enormously if people ensure they are not paying too much to the banks. The money being wasted on high-interest rates could be better spent in our local economy.

If you would like to take a look at your interest rates please contact us for a review.

Umina Beach Median House Price (Feb 2023)

Umina Beach property market summary (Feb 2023)

Last month Umina Beach had 116 properties available for rent and 100 properties for sale. Median property prices over the last year range from $1,060,000 for houses to $827,500 for units. If you are looking for an investment property, consider houses in Umina Beach rent out for $540 PW with an annual rental yield of 2.7% and units rent for $480 PW with a rental yield of 3.3%. Based on five years of sales, Umina Beach has seen a compound growth rate of -3.6% for houses and 6.1% for units.

Central Coast House Prices - May 2023

Our Central Coast house price results are out for May 2023.

Whilst the median house price dropped from $955,202 to $951,420, the rate of decline has slowed this month. The drop from March to April was almost $20,000.

This median house price level was last seen back in December 2021. Amazingly, only 18 months prior to this date, the median house price was $300,000 lower. To put this into mortgage perspective, an additional $300,000 in borrowings would have a weekly repayment of $415, based on a 6% interest rate over a 30-year loan term.

The ranked table below shows 20 Central Coast suburbs with the highest number of houses. We have shown you the median house prices from January to May. As you can see, the trend is heading down for every suburb on this list. Although, some have fallen quite a lot more than others.

As always, we encourage you to call or email us if you have any questions at all.

The above chart (Feb 2024) compares the Central Coast market to the various Sydney and NSW markets.

As you can see, our units and houses have underperformed in most Sydney markets but overperformed in almost all NSW regional markets.

This chart also confirms our data showing that house prices outperform unit prices on the Central Coast. Potentially, the large increase in new unit supply compared to lower land release numbers makes units more affordable.

If you would like to talk to us about your property plans, please give us a call to discuss your options.