Mortgage Choice Home Loans SmartSelect – Frequently Asked Questions

Mortgage Choice Home Loans SmartSelect is available exclusively through your Broker. Your Broker can help manage the entire application and approval process. They’re your best source of information about Mortgage Choice Home Loans SmartSelect and the application process to help ensure you get the home loan that’s right for you.

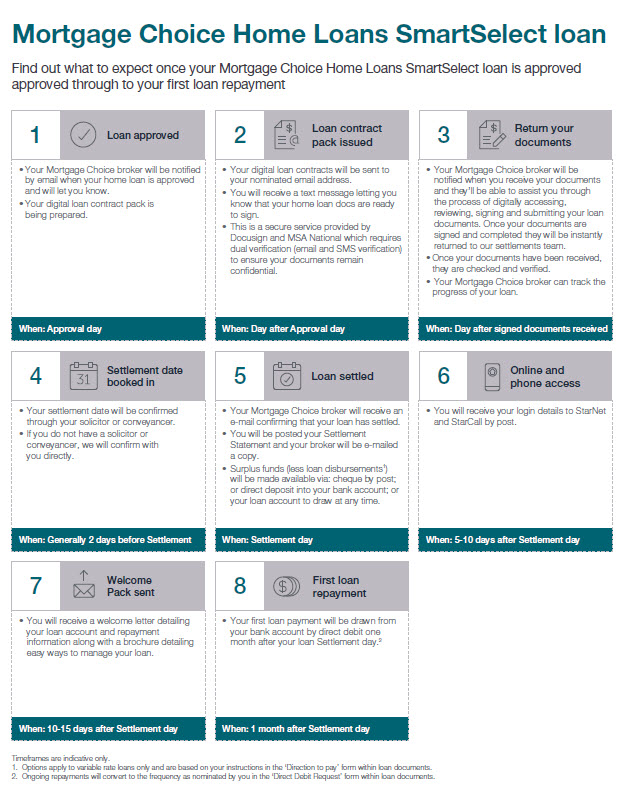

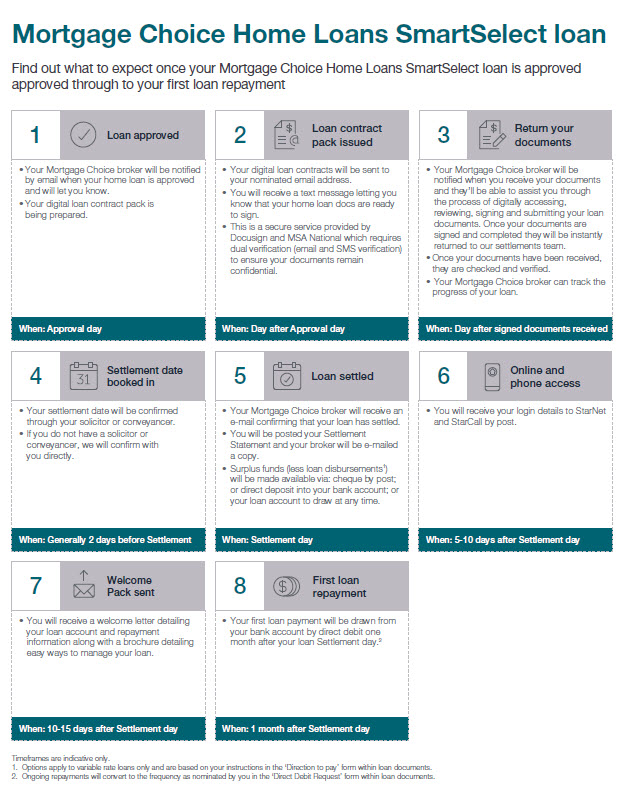

What happens next?

Find out what to expect once your Mortgage Choice Home Loans SmartSelect home loan is approved through to your first loan repayment.

New Customers: FAQs

How can I apply for Mortgage Choice Home Loans SmartSelect loan?

Please contact your Broker to apply and lodge your application.

What documents do I need to provide when applying?

When you discuss your home loan with your Broker, he/she will inform you of the relevant documentation required to apply for a Mortgage Choice Home Loans SmartSelect loan.

What’s the difference between a fixed and a variable rate home loan?

A fixed rate loan means that the interest rate, which applies to your loan, will stay the same for a fixed period. For example, if you take out a 3-year fixed rate home loan, the interest rate will be the same throughout the 3 year fixed rate term, which means you know exactly what your repayments will be during that term. A variable rate loan means that the interest rate may change from time to time throughout the life of the loan.

Current Applicants: FAQs

Mortgage Choice Home Loans SmartSelect is available exclusively through our Brokers. Your Broker can help manage the entire application and approval process. They’re your best source of information about your application.

Who do I speak to about Mortgage Choice Home Loans SmartSelect loan?

Please go to the Contact Us section of this page.

Current Customers: Post-Settlement FAQs

Who do I speak to about my Mortgage Choice Home Loans SmartSelect loan? How can I contact Mortgage Choice?

You can contact the CustomerCare team on 1300 543 558 from 8:00am-8:00pm (AEDT) Monday to Friday for queries on your loan. Or to contact a Broker, please go to the Contact us section below.

What happens to my extra funds at settlement?

Surplus funds will be made available as set out in the Direction to Pay form you sign.

Can I make a deposit into my loan at a NAB Branch?

Yes. You will need to complete a deposit slip with the BSB and account number we give you in your Welcome Pack. A fee applies to manual transactions.

Note: The teller will not have access to your loan account details in the loan systems. You can ask the teller to treat the deposit as a “back office” transaction. If there is any confusion, ask the teller to call CustomerCare on 1300 543 558 to assist.

How can I make additional repayments on variable rate loans?

Electronically via StarNet or StarCall:

– You can set up one off or ongoing payments on StarNet or via StarCall at any time, at no cost.

How do I request a recalculation of my repayments?

Please complete the Repayment Request form and return the completed form to the CustomerCare team:

– By email to mchlsmartselect@mycustomercare.com.au

– By post to Advantedge Financial Services Pty Ltd CustomerCare, P.O. Box 626, Collins Street West, Melbourne VIC 8007. Ongoing additional payments made electronically do not attract a fee.

How do I increase my loan amount?

Contact your Broker to arrange an appointment to discuss your request#.

How can I change my repayment frequency?

You can change this in StarNet. Alternatively, please complete the Repayment Request form and return the completed form to the CustomerCare team:

– By email to mchlsmartselect@mycustomercare.com.au

– By post to CustomerCare, P.O. Box 626, Collins Street West, Melbourne VIC 8007. Ongoing additional payments made electronically do not attract a fee. You can also provide a letter requesting the change, signed by all borrowers, and send it to the CustomerCare team by email or post as shown above.

Redraw information

How can I find out the amount of funds I have available to redraw?

You can check your loan account via StarNet or StarCall to view your available redraw^ amount anytime or call the CustomerCare team on 1300 543 558 from 8:00am-8:00pm (AEDT) Monday to Friday.

Can my redraw be transferred into any account?

No. Any redraws^ you request can only be paid into the linked account that you nominated on your Direct Debit Request form.

How can I redraw on my vacant land / construction / fixed rate loan?

Redraw is not available on fixed rate loans. Any available redraw^ on construction and vacant land loans can only be accessed by completing the Redraw Requests & Transfers form and returning the completed form to the CustomerCare team:

– By email to mchlsmartselect@mycustomercare.com.au

– By post to Advantedge Financial Services Pty Ltd CustomerCare, P.O. Box 626, Collins Street West, Melbourne VIC 8007

Complaints and Disputes Resolution

View Complaints Resolution and Hardship Guide (Mortgage Choice)