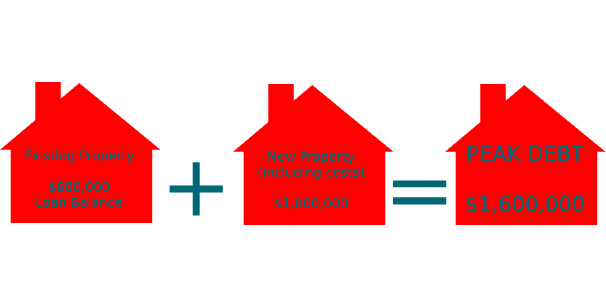

When you take out a bridging loan, the lender takes a mortgage on your existing property as well as your new property.The total loan amount is called the Peak Debt, and is basically;

-

the loan on your existing home PLUS

-

the contract purchase price of the new home and any purchase costs such as stamp duty.

The repayments on a bridging loan will generally be split in two;

Peak debt – Balance of existing loan, contract price of new property, and purchase costs. Repayments are generally capitalised to the loan (added to the loan)

End Loan – Your expected ‘end-loan’ once your existing property is sold (including sale proceeds, etc). Repayments are generally Principal & Interest (more information on loan repayment types)