Property Investment Loans | Mortgage Broker Melbourne CBD, Port Melbourne & Brighton

We're passionate about investment loans

We're passionate about investment loans because of what they represent: a strategy to build wealth for the future. There are so many pathways to invest in property and strategies for your future self. Our Mortgage Broker Melbourne team will customise a flexible solution that will support your growing portfolio and help you maximise your cash flow.

Our investment loan service includes:

- Experienced investment loan advice that's tailored to you: After 25 years in the Mortgage Broker industry, our team brings a wealth of knowledge when it comes to choosing the right investment loan and structuring it correctly. We meet with you to find out more about your plans and budget and guide you through your options to make sure you make a sound investment choice.

- Access to thousands of options: With access to a diverse panel of more than 35 banks and lenders, we do the shopping around from thousands of investment loan options. Our Mortgage Choice Melbourne team will make sure that our recommendations meet your needs and support your unique strategy.

- Support from our team until settlement and beyond: While we manage all the heavy lifting and admin of your new investment loan, our commitment doesn’t stop at loan approval. We’ll continue to provide support as your investment grows, ensuring you’re always in a strong financial position.

- Consultation with your other service providers: To effectively maximise your investment returns, it's important to have a team of experts in your corner: a financial adviser, accountant, solicitor and mortgage broker (like us!). To make it easy, our Mortgage Choice Melbourne Brokers work directly with the other professionals on your team, so you don't have to play middleman and still get the same seamless support.

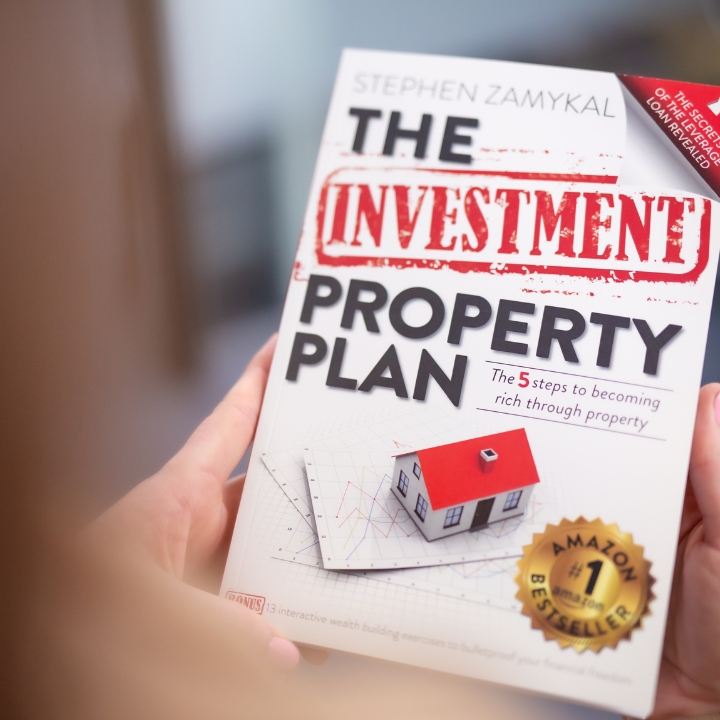

Amazon #1 Best-seller by Stephen Zamykal

Our very own Stephen Zamykal has his own Amazon best-seller 'The Investment Property Plan', which aims to take the fear and guesswork out of investing in property and put you on the path to financial freedom. Contact us to get your own copy!

Check it out on AmazonInvesting through your self-managed super fund (SMSF)

The beauty of SMSF investment is that you can choose how your money is invested for your retirement. Many people with self-managed super funds choose to use their money to invest in property. But, SMSF property loans can be complex and come with plenty of regulations. It's important to consult your team of experts like your financial adviser and mortgage broker. Stephen is an expert in SMSF lending and property investment and has been helping our clients leverage their super for over 25 years. Get in touch with us for your own personalised SMSF strategy.

Our investment clients at Mortgage Choice Melbourne:

"I had no idea what I would be able to afford for an investment property, but they helped me through the whole process. I was able to buy within 1 month of my first appointment with them. They have continued to touch base with me annually and they have helped me with an interest rate reduction on my home loan. I can't believe how helpful and supportive they have been to me as a single buyer and not very knowledgeable about these things." (Jenny, Port Melbourne)

Ready to kickstart your investment loan journey?

We've got 25 years of experience in investment loans and are ready to put our experience to work for you. Our Mortgage Broker Melbourne team can chat by phone, video or in person at either of our two offices. Let's get started and see if we can save you money!

Call 03 8602 6777 Email us Book an appointment

Visit one of our offices